How We Help You Prepare to Retire

*Prepared by Raymond James for use by Mainsail Wealth Advisors Financial Advisors Raymond James Financial Services, Inc. Member FINRA/SIPC

*Prepared by Raymond James for use by Mainsail Wealth Advisors Financial Advisors Raymond James Financial Services, Inc. Member FINRA/SIPCSocial Security

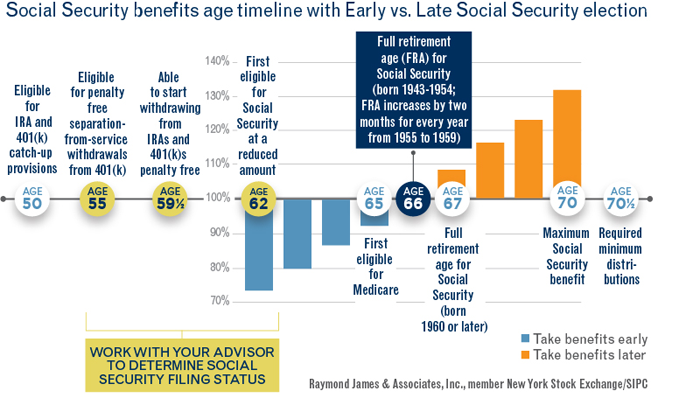

For many people, Social Security will provide the foundation of their retirement income. Understanding your options and the long term impact of each choice is an essential step before embarking on your retirement. Should I wait until my full retirement age? Can I go back to work once I begin receiving benefits? How will my benefits effect my taxes? Our experienced team of advisors will work with you to lay out a strategy that fits your unique situation so you can be confident you are making the best decision when it comes to managing your Social Security benefits.

Pension Analysis

For those who are fortunate enough to have a pension, the options are often daunting. Should I choose survivor benefits for my spouse? Are there cost of living adjustments? Should I take a lump sum payout, or monthly income? The decisions you make on your pension benefits can have a profound impact on your financial plan and should not be made without careful thought and consideration. Our team can help retirees navigate this process in conjunction with your personal comprehensive financial plan and will work with you to make the best decision for you and your family.

Managing your 401k

You have built up a nest egg to help you retire on your terms and provide you with the freedom to do the things you want in retirement. Since you will no longer be adding to your savings, helping to ensure it lasts for your entire life is job number one. Managing your savings during retirement requires a vastly different approach than you many have employed during your accumulation phase.

Generating income, managing volatility, and developing withdrawal strategies is a unique skill set that can help you maintain your nest egg through the ups and downs of the markets. Our team of advisors has the experience and competence to design and manage investment strategies specifically designed to help meet your income needs as you travel through retirement so you can focus on what’s most important to you.

Creating a Plan

We firmly believe that every client needs a financial plan in order to achieve their goals. That’s why we start with understanding your objectives, modeling out your income needs over time, and matching our recommendations to your specific goals and objectives. Doing this helps us keep your big picture in mind through the ups and downs of the markets. It also helps us to design investment strategies with risk management as a top priority. At Mainsail Wealth Advisors we stress test hundreds of good and bad market scenarios so you feel confident that you are on the right track regardless of how volatile the markets might be from day to day.

*You should consider all of your available options and the applicable fees and features of each option before

moving your retirement assets.