|

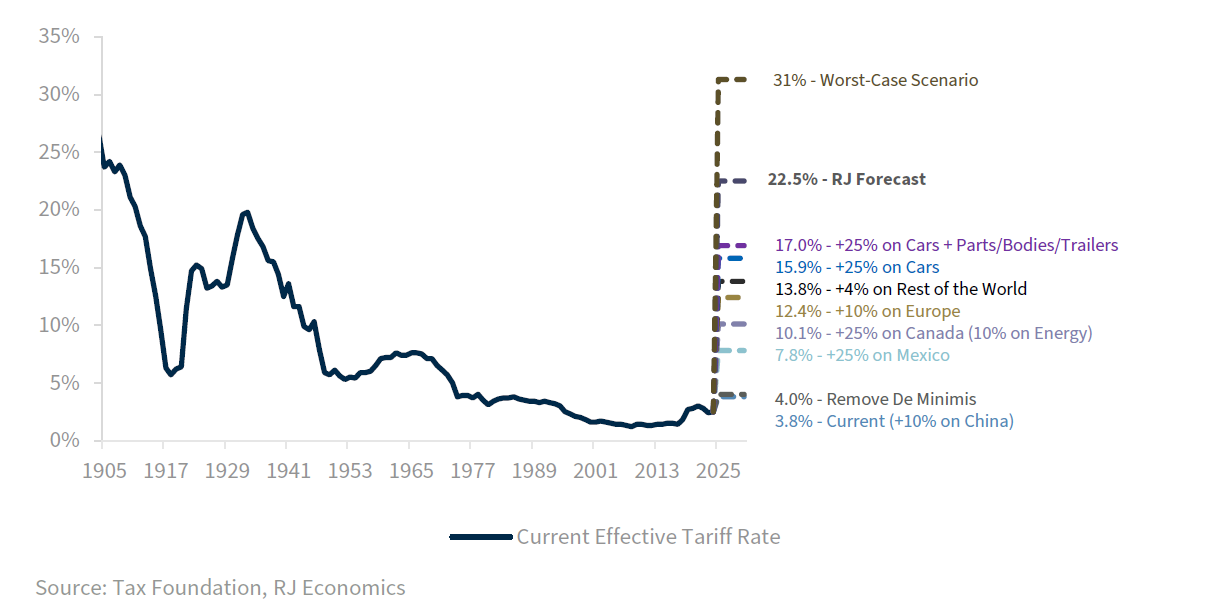

Markets were surprised last week by the announcement of sweeping new “reciprocal” tariffs, which dramatically raise the U.S. average tariff rate to levels not seen in over a century. While investors had expected tariffs, the magnitude of the announcement took many by surprise. Introduced after markets closed on Wednesday, the new measures sparked an immediate reaction and elevated concerns around inflation, trade dynamics, and recession risk.

|

|

|

In addition to across the board 10% tariffs, some individual countries were hit with higher tariffs which are set to go into effect later this week. Notably absent from the announcement were Canada and Mexico, our two largest trading partners. The next key date we are watching is Wednesday April 9, when the higher tariffs targeting specific countries are scheduled to take effect. Until then, markets are likely to remain focused on whether the announced tariffs are a short-term negotiating tactic—or the start of a longer-term shift in U.S. trade policy. This distinction matters, as it could influence how both companies and investors position themselves for the months ahead.

|

While periods of volatility are normal and factored into the financial plans and portfolios we build, the politically charged environment we find ourselves in can make emotions run hot. As markets search for equilibrium, they often rise gradually over time—yet when uncertainty spikes, declines tend to be sharp and sudden. The past two years have shown how slow, steady gains can be quickly interrupted by short bursts of downside volatility—a pattern that has played out time and time again throughout history.

|

|

|

Tariffs: A Historical Context

|

|

|

KEY DEVELOPMENTS WE ARE MONITORING

|

- President Trump has signaled that some countries (e.g., Canada, Mexico, Vietnam) could receive exemptions if favorable trade terms are offered, suggesting this may still be a bargaining tool rather than a fixed strategy.

- China, by contrast, continues to be a focal point of the administration’s tariff policy, raising the risk of escalation between the world’s two largest economies - implying the proposed tariffs are not a negotiating strategy.

- While U.S. markets underperformed Global markets on Thursday, Friday and Monday saw U.S. markets outperform. If this trend continues, it may give the U.S. additional leverage in negotiations – should that be the approach taken by the White House.

- Economic indicators—including labor market strength, corporate earnings, consumer sentiment, and inflation readings—remain mixed, adding to the uncertainty.

- Markets have shown increased sensitivity to headlines, with notable swings tied to tariff-related updates and speculation over policy intent – which remains unclear

|

It’s worth considering the historical context. The S&P 500 declined nearly 10% over just two trading sessions following the tariff announcement—an unusually sharp move. There have only been three other instances in the past 50 years when the index dropped that much, that quickly: during the 1987 crash, the 2008 financial crisis, and in March 2020 at the peak of COVID-related uncertainty. Each of those periods, while uncomfortable in the moment, ultimately proved to be long-term buying opportunities. While every environment is different, history suggests that making significant portfolios changes in reaction to market declines has often been the wrong call.

The last two trading sessions have highlighted just how quickly markets can reverse course on the heels of a positive headline. From intraday low to high, the S&P 500 moved more than 9%—a level of volatility that’s typical around potential inflection points, when investors are searching for a bottom and trying to anticipate what comes next. These sharp swings underscore how challenging it is to navigate the environment with precision or conviction in the short term.

History shows that leadership in the market shifts over time, and today’s dominant stocks won’t always be the primary drivers of returns. Our investment approach carefully reflects this view and is why we remain focused on maintaining diversification in your portfolio even when it is tempting to chase the hot stock or sector.

|

|

|

S&P 500 - April 7th - April 8th

|

|

|

HOW WE ARE THINKING ABOUT ANY POSSIBLE ALLOCATION CHANGES

|

The recent policy shift towards more aggressive tariffs has introduced meaningful uncertainty. If these measures prove to be more permanent, they could justify changes to asset allocation. That’s something our Investment Committee is closely monitoring.

While recent developments have introduced new questions about policy direction and economic impact, we believe it’s essential to have a clear understanding of where things are headed before making changes. Right now, too many unknowns remain, both in terms of how policy will evolve and how both individuals and companies will respond.

Rather than speculate, we’re staying focused on monitoring the most important signals: what companies are saying, how inflation and employment are trending, and how global trade relationships may shift. Once the path forward becomes more defined, particularly as it relates to the long-term direction of tariffs, we’ll be in a better position to make prudent, well-supported adjustments where needed.

|

|

|

|

|

If you have any questions about your specific plan or situation, please reach out and setup a time for us to connect.

|

|

|

|

|

We’re incredibly grateful for the trust you place in us and for the many introductions you’ve made over the past year. It’s always an honor to serve you and those you care about.

During volatile markets, financial questions often come up—whether it’s about investments, retirement, or just making sense of the headlines. If you know someone who might find this perspective helpful or has questions of their own, feel free to share this with them. We’re always happy to be a resource.

|

|

|

To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any opinions are those of the author, are subject to change and are not necessarily those of Raymond James. This material is being provided for information purposes only, does not purport to be a complete description of the securities, markets, or developments referred to herein and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.

© 2022 Raymond James & Associates, Inc., member New York Stock Exchange / SIPC.

|

|

|

|